Every year in London two Islamic Art Weeks are held in October and April, in which the three major auction houses (Bonhams, Sotheby’s and Christie’s) organize their four traditional sales of Islamic Art. The last Islamic Art Week, Spring 2016, took place in mid-April.

The sales can be analyzed in different ways: the objects sold, the prices realized, the differences in the offer among the auction houses.

But how is going the market of Islamic art as a whole and what will be its future?

Besides the traditional four sales that the three houses run every year, Sotheby’s and Christie’s enlarged their offer, organizing related auctions.

Sotheby’s, celebrating its 40th year of holding specialized Islamic art sales, set up a structured Orientalist & Middle Eastern Week, comprising in total five sales, among others of Orientalist paintings, 20th-century art of the Middle East and pieces from the library of Mohamed and Margaret Makiya. Some pieces of the same collection featured in another ad-hoc sale run by Christie’s.

With such an enlarged offer (a total of nine sales), the market expectations were great. In an article signed by Colin Gleadell for The Telegraph, the sales of Islamic art were expected “to raise some £25 million”. In fact, the figures are not that high: the nine sales together raised slightly more than £20 million (£20,053,098). Thus, we can candidly admit that the expectations were not met.

Even more, if we only look at the four traditional auctions, it is clear that the sales in the market are not booming, not at all.

The fluctuation

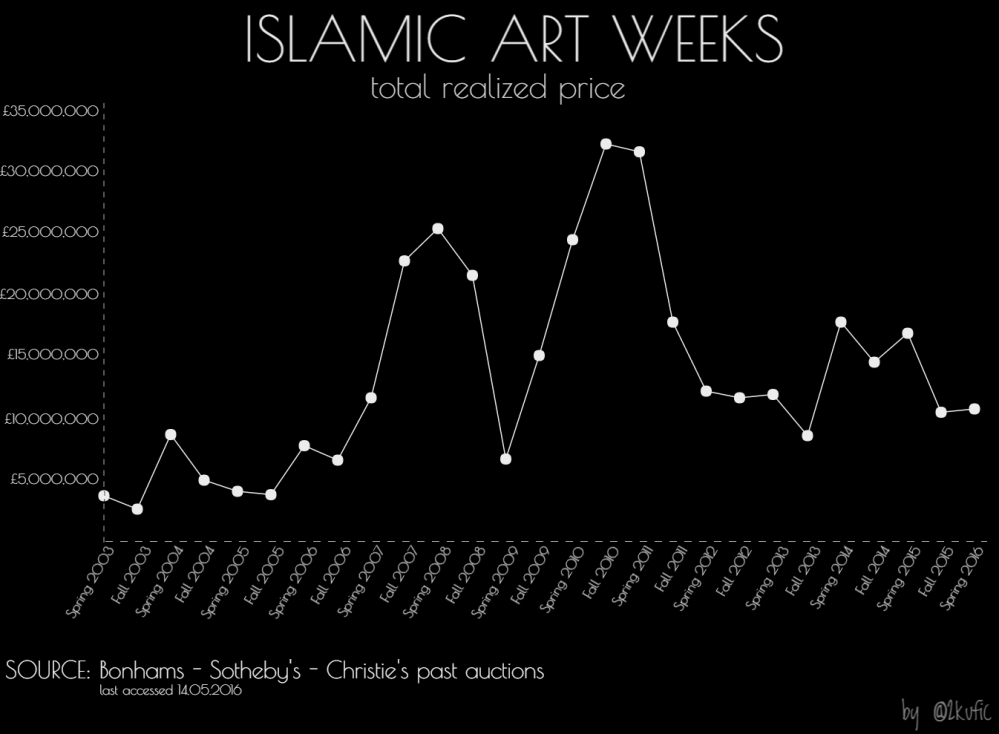

The four core auctions of Sotheby’s, Bonhams and Christie’s raised in total £10,682,551. Overall, 574 lots were sold: considering that 1053 lots were on sale, the 55% of them has been sold, a percentage in line with the previous auctions. But if the percentage of the sold lots has not dramatically changed, the revenue has, even more so if taking into consideration the past Islamic art weeks. If we look back at the Islamic art week, Spring 2014, the difference is clear: back then the four traditional sales raised more than £17 million. In Spring 2010, the realized price was more than double if compared with Spring 2016: nearly £24,5 million.

Another symptom of the downward parabola Islamic art has taken in the last few years is the highest realized price per Islamic art week. In Spring 2015, the lot sold for the highest price was the Tipu Sultan sword sold by Bonhams, with a realized price of £2,154,500: a quite unique and exceptional price actually. Nevertheless, during both Fall 2014 and Fall 2015, the highest realized price was £962,500: three times more than the highest sold price during the last Islamic week – £386,500.

Generally speaking, sales in Islamic art are not going as well as they used to.

Yet, if the results of the last sales are seen in a more general perspective, probably they are not that negative.

The bigger picture and the external factors

From the chart, it is quite clear, once more, that Islamic art sales used to be better, but it also seems that London Islamic art weeks are slowly recovering, at last. Much needs to be done to get back to the same level the art market reached in Fall 2010 when the four sales raised more that £30 million, but the slight increase registered between Fall 2015 (£10.380.589) and Spring 2016 (£10,682,551) is probably a positive sign.

Historically, Spring auctions have in fact been considered to raise smaller amounts if compared with Fall sales. This is due to the fact that it is considered that the majority of buyers are from wealthy Middle Eastern families “that move to London for the Summer and early Autumn to avoid the excessive heat in their home countries” (McQuillan&Lucey, 2008). This, combined with the data, could lead to a quite positive conclusion.

Anyhow, Islamic art market, just as every market, does not exist in a void. It is influenced by external factors, the main being the fluctuation of oil price and the general perception of the Islamic culture in relation to political events. McQuillan and Lucey have underlined, for instance, how after 9/11 the market of Islamic Art was deeply influenced. The political situation in the Middle East today for sure does not help the market, but it’s also true that perception is difficult to define and calculate, if not after years. Also, predictions in this topic are difficult and mostly biased.

A much closer and objective relation is to be found in the Islamic art market and the oil price. As again McQuillan and Lucey point out, the majority of the Middle Eastern wealthy collectors draws its wealth from the oil market, thus, a relation or better an effect of the oil price over the Islamic art market is plausible. Comparing the chart of the London Islamic Weeks results with the one of the OPEC basket price per year, this connection is even clearer. For instance, after 2009 the oil price starts recovering after having dropped. Similarly, the total realized amount during Islamic art weeks in the same period was on the rise.

The descending parabola of the oil market affected the results of the latest Islamic art auctions, no doubts, but it is also true that the oil price has started increasing since February this year, according to OPEC records. If the trend persists, it is possible that also Islamic art market will be recovering soon.

…and new actors

The London Islamic art week is still the most important event in the scene of the Islamic art market, but it starts to be challanged by those states whose citizens have been for so long the essential buyers in London: the Emirates and the Gulf states. In Doha, the first Qatari auction house, AlBahie, has opened just a month before the London Islamic art week where the first sale of Islamic and Orientalist Art was held the 5th of April, some two weeks before the Islamic Art Week of London. The opening can be seen as the latest result of the collection practices and investments in the culture field performed by the Qatari dynasty and it will not be a surprise if other dynasties of the Gulf will emulate Qatar in this.

Probably London auctions are recovering, but the traditional houses will need to confront a new, big, and powerful competitor and, in the long run, a number of changes in the market are to be expected, coming directly from the Islamic lands.

THE SALES (in italics the four ‘traditional’ ones):

Bonhams

19 April 2016, Islamic and Indian Art

Sotheby’s

19 April 2016, Library of Mohamed & Margaret Makiya

19 April 2016, The Orientalist Sale

20 April 2016, Arts of the Islamic World

20 April 2016, 20th century Art / Middle East

21 April 2016, Alchemy: Objects of Desire

Christie’s

18 April 2016, Islamic Manuscript Feat. The Mohamed Makiya Collection

21 April 2016, Art of the Islamic & Indian Worlds

22 April 2016, Arts & Textiles of the Islamic & Indian Worlds

For some insights on the four traditional sales, take a look at the infographic.

2 Comments Add yours